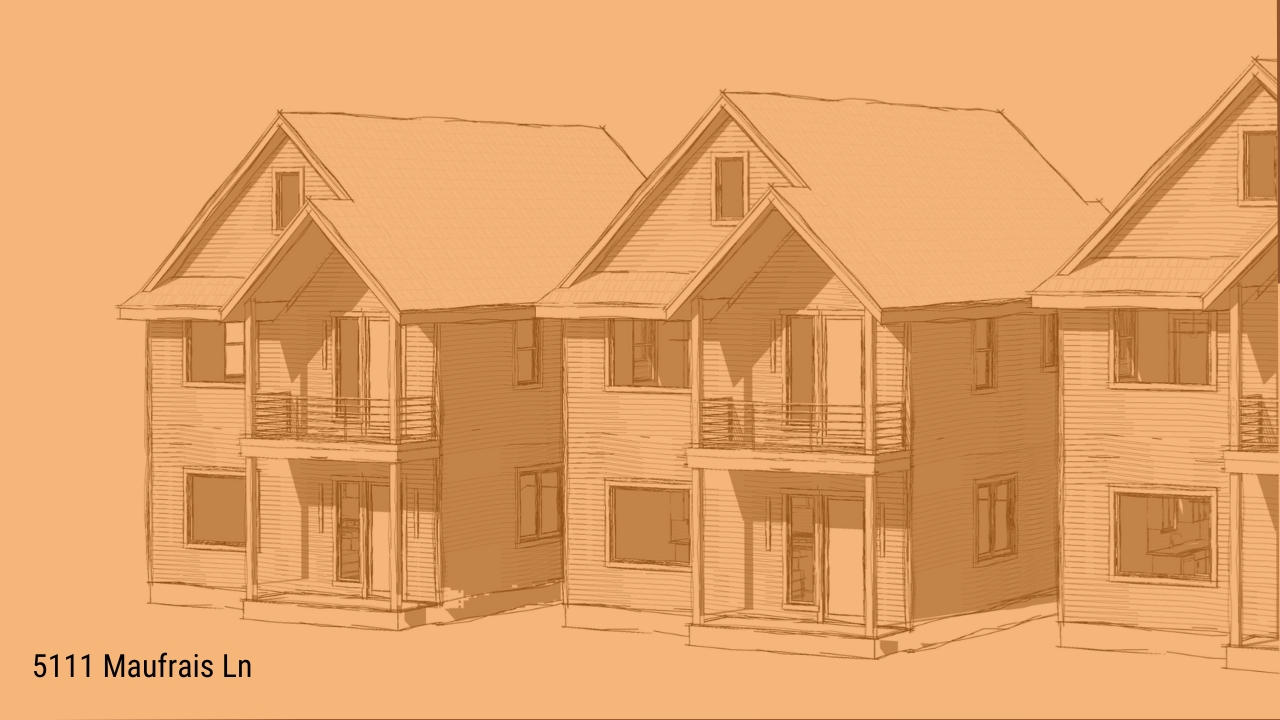

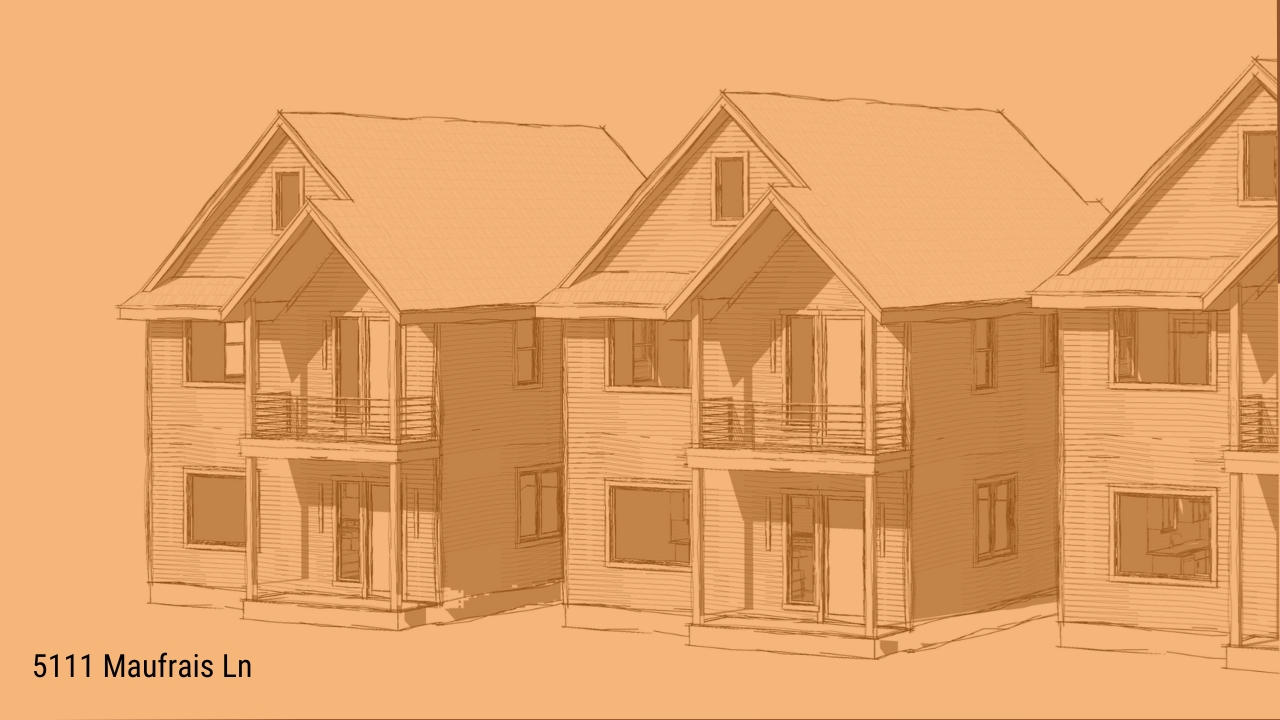

5111 Maufrais – April ’24 Update

5111 Maufrais Ln – project update April ’24 including development plan, status of project with COA and subdivision procedures.

5111 Maufrais Ln – project update April ’24 including development plan, status of project with COA and subdivision procedures.

Opportunity zones are designed to incentivize investment in communities that are struggling economically. Investors can receive significant tax benefits that will encourage investment in these areas and stimulate economic growth and create jobs.

Discover the resilience of the Austin real estate market in Q1 2024. Explore key trends, insights, and opportunities for buyers and investors.

Discover how NAR’s proposed settlement reshapes real estate practices, preserving consumer choices while addressing litigation concerns. Stay informed!

We’re thrilled to announce a significant milestone in the journey of Liquidoz.com – the launch of fundraising for the 107 W Johanna Project!

Discover why 10% zero coupon notes triumph over savings accounts. Dive into compounding growth, predictable returns, and tax efficiency.

Discover how real estate developers are revitalizing underserved communities in Opportunity Zones, enhancing infrastructure for lasting impact.

In the realm of real estate investing, two prominent strategies vie for attention: the venerable 1031 exchange and the burgeoning Opportunity Zone (OZ) fund

Liquid subsidiary QOZB Capital increase yield on their zero coupon note product to 10% APR.

Unlock the top investment opportunities in Austin’s Opportunity Zones! Explore key areas and success stories in our comprehensive top 10 list.

Phase 1 of our residential development at 5111 Maufrais has been approved by the COA. We are clear to build three residential homes.

Unlock investment potential in Austin’s Opportunity Zones! Discover benefits, opportunities, and success stories in our comprehensive blog post.

We’re thrilled to announce that the price for our Austin duplex at 935 E 51st has just dropped. Come own a piece of the vibrant Austin real estate market.

Austin’s city council has approved plans to increase the density allowance for housing. This will have a very positive impact on Liquid’s residential projects.

The CoA has scrapped the Project Assessment requirement for development applications. What does this mean for development in the city’s many opportunity zones?

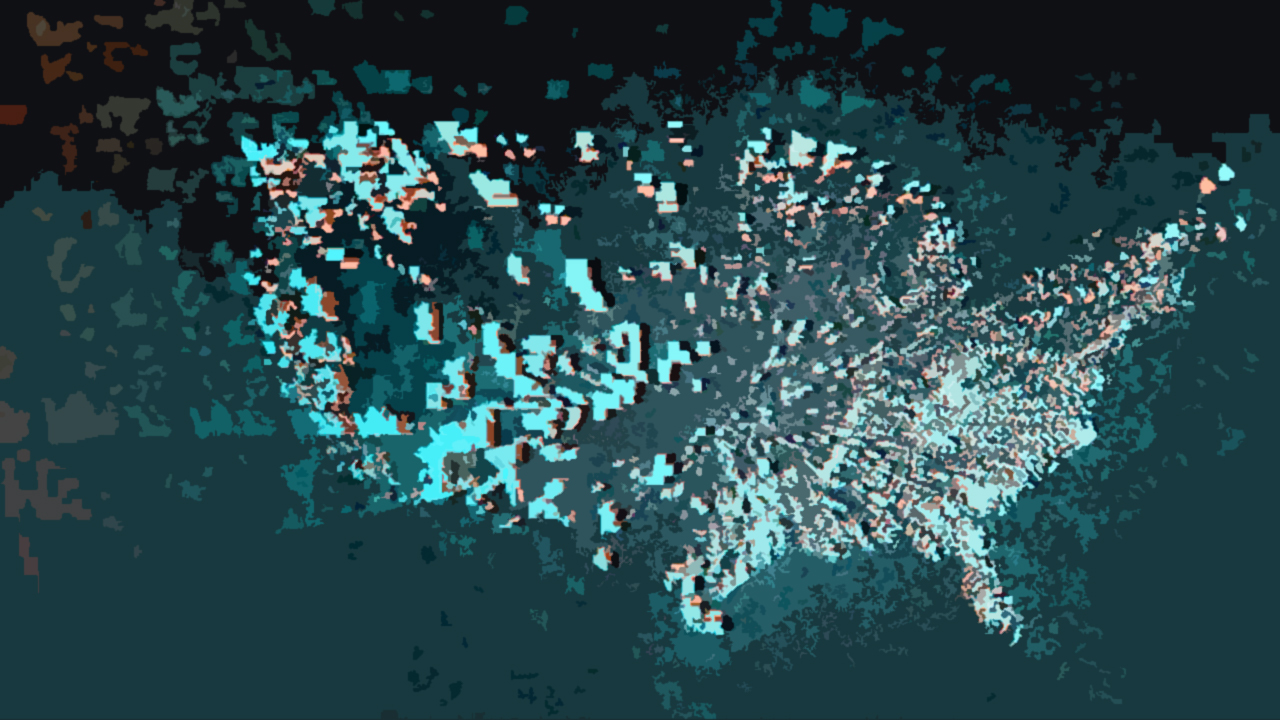

Texas and its demographic delights – why the Lone Star state has the best demographics in the USA.

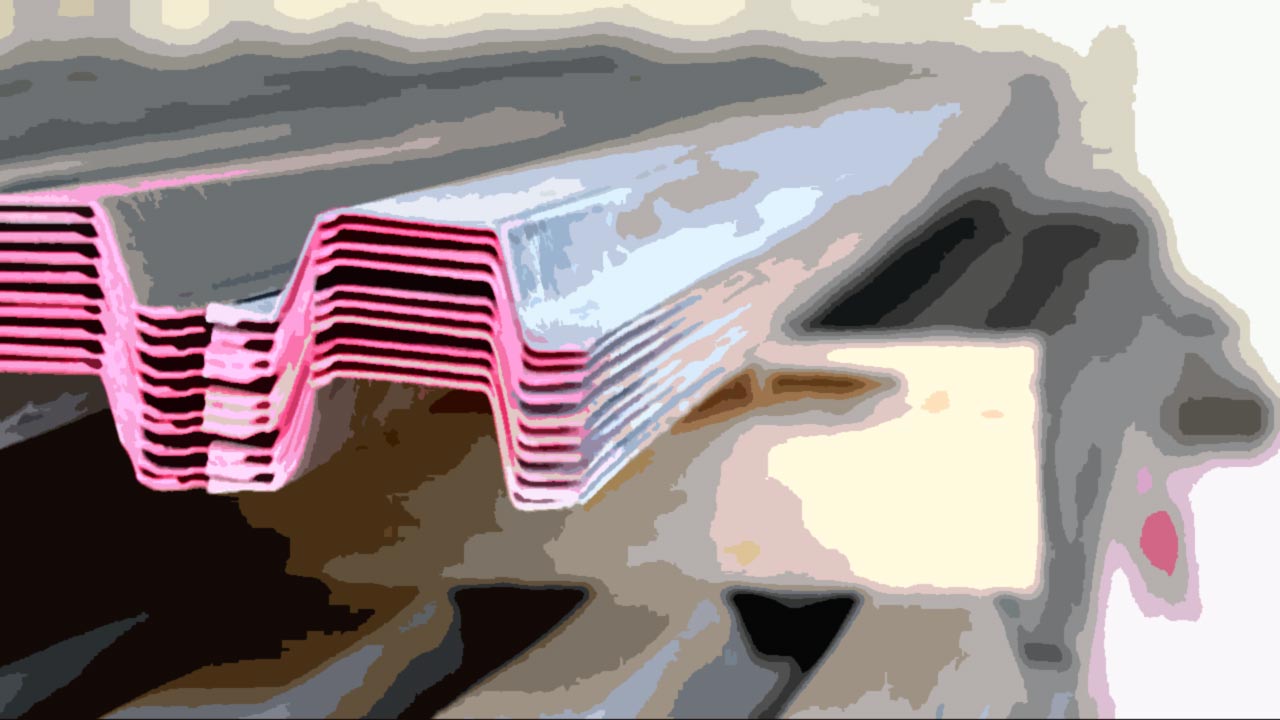

PACE financing, also known as Property Assessed Clean Energy financing, is a public financing program that helps property owners finance energy efficiency.

The City of Austin provides a series of InFill Development Tools that developer can utilize to increase the density and profitability of projects in Austin.

Our townhouse development at 1201 Montopolis Dr just took a huge step forward today with the completion of the subdivision application to the city.

Learning how to subdivide land in Austin? The Austin site plan process isn’t a complex as many believe, meaning subdividing in Austin is achievable for anyone.

The completed siteplan for the sub-division of 5111 Maufrais Ln has been submitted to the City of Austin development services for final approval.

2023 is a big year for opportunity zone investors. Here is a breakdown of how the tax incentives for OZ investors work in 2023.

The city council of Austin is creating a development density bonus to encourage building on single-family lots, with affordability requirements.

As an entrepreneur looking to start or grow a business in an Opportunity Zone, there are several things to consider before diving in. In this blog post, we’ll provide some insights and best practices for navigating the Opportunity Zone investment landscape.

What is the process to get a project assessment on a Real Estate project in Austin? Who needs a project assessment? And what are the benefits?

What are the demographics of opportunity zone investors? Understand who OZ investors are and what drives their investor habits.

Let’s delve into the top Opportunity Zones of 2023 and explore what makes them so attractive.

We are highlighting the 10 most important numbers to know about investing in Opportunity Zones (OZs).

Which Opportunity Zones in Texas have seen the most investment? Let’s look at the five most developed Opportunity Zones in Texas.

Here are some crucial questions you should ask a real estate or OZ fund manager before investing with them.

What are investors hoping to achieve when they invest in funds? Here are the 5 most common goals opportunity zone and real estate investors.

Here are the top five alternatives to a 1031 exchange available for investors who are selling property and managing their capital gains tax.

The program is designed to incentivize investment in low-income communities by providing tax benefits to investors who invest in these areas.

One area where OZs have been particularly effective is in the development of single-family homes. Here are five single-family oz funds.

Opportunity Zones have the potential to drive economic growth and revitalize neighborhoods, and Texas is home to many such zones.

What can you expect when you invest with Liquid? Hear directly from our opportunity zones and cryptocurrency fund investors.

Cryptocurrency is the fastest appreciating asset class in human history. Future wealth creation will rely on how effectively funds and individuals deploy capital into blockchain assets and technology.

Liquid is building a startup campus right here in East Austin. We are currently seeking suitable development sites in the Parker Lane, East Oltorf and Montopolis neighborhoods.

Do you need to keep your 1031 property forever? No. But there are guidelines for when and how you can sell a property that you bought through a 1031 exchange.

So what do you do if you’re sold a property and missed the 45 day identification window? You may think your only choice is to pay the associated capital gains taxes. But you’d be wrong.

The IRS has granted additional relief to QOFs, QOZBs and their investors, under IRS Revenue Procedure 2020-34. This COVID relief is much more generous than what had been previously granted.

Building materials in Austin are expensive and poor quality. We have it on good authority that the price of all construction materials in Austin, TX is through the roof.

How do you plan the sale of an asset around re-investing the proceeds into a a qualified opportunity zone fund? Plan strategically.

Parker Lane is significantly under-served by rental properties. While only 15% of residents own their homes, the market isn’t meeting demand.

In this blog post, we will take a closer look at how Opportunity Zones are revitalizing communities and why they are a game-changer for urban renewal.

Why invest in Montopolis? Liquid QOZB rehabs and ground-up builds single family residential properties in the Montopolis neighborhood.

Stay informed about the latest real estate trends and news with the dedicated news section of Liquid’s website.

Our news section provides you with up-to-date information on the latest real estate trends, market news, and investment opportunities.

We cover a wide range of topics, including:

We also provide you with access to exclusive content, such as interviews with industry experts and analysis of market data.

Our news section is a valuable resource for anyone who wants to stay informed about the latest real estate trends and news. Whether you’re a seasoned investor or just getting started, we have something for you. Visit our news section today and stay ahead of the curve.

Here are some additional benefits of reading the news section of a real estate fund’s website:

If you’re interested in real estate investing, I encourage you to check out the news section of a real estate fund’s website. It’s a valuable resource that can help you stay informed and make better investment decisions.