The Austin real estate market has been a hot topic for investors, homeowners, and analysts alike. With its booming tech industry, vibrant culture, and attractive lifestyle, Austin has consistently attracted individuals and families seeking to put down roots in the Lone Star State. Our fund aims to develop projects across Austin’s opportunity zones. To that end, as we delve into the stats for Q1, provided by ALEX, we gain valuable insights into the market’s performance, trends, and potential areas of opportunity or concern.

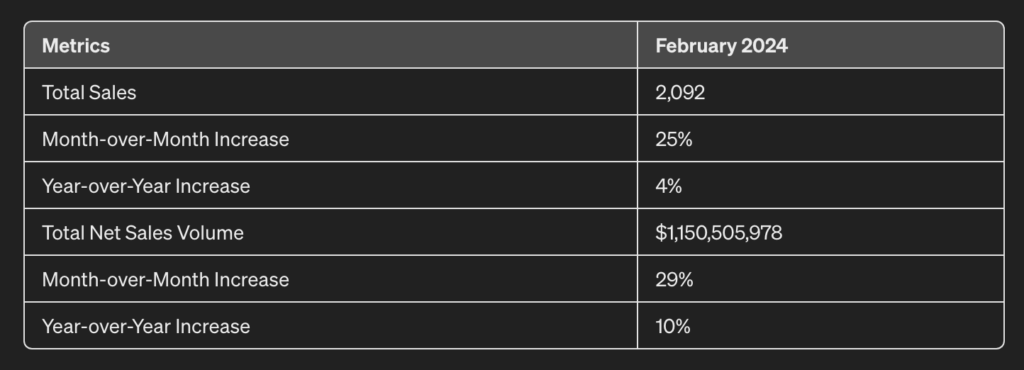

In February 2024, the Austin MLS reported a total of 2,092 single-family home sales, marking a significant 25% increase from the previous month and a 4% rise from the same month last year. This surge in sales activity is indicative of the market’s resilience and continued attractiveness to buyers. Additionally, the total net sales volume reached $1,150,505,978, demonstrating a robust 29% increase from the previous month and a notable 10% uptick from the same period last year.

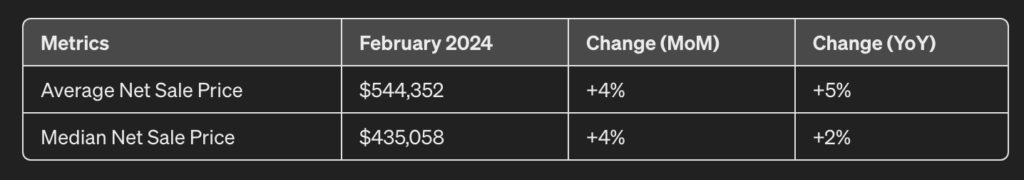

The average net sale price for homes in Austin stood at $544,352, reflecting a 4% increase from the previous month and a 5% rise from the same period last year. Similarly, the median net sale price increased by 4% month-over-month, reaching $435,058. These figures indicate a healthy appreciation in property values, underlining the city’s desirability as a real estate investment destination.

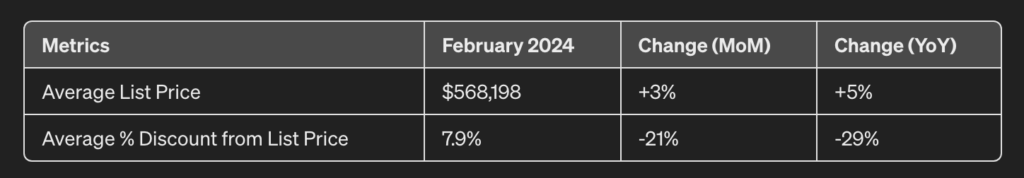

The average list price for homes in Austin also saw an upward trend, rising by 3% from the previous month to $568,198. However, the average discount from the list price decreased significantly by 21% compared to the previous month, indicating stronger demand and potentially more competitive bidding among buyers. This could be a sign that income investors need to move quickly to secure high-quality rental portfolio assets in Austin. The median discount also experienced a notable decline of 29%, further illustrating the market’s resilience and sellers’ ability to command favorable prices.

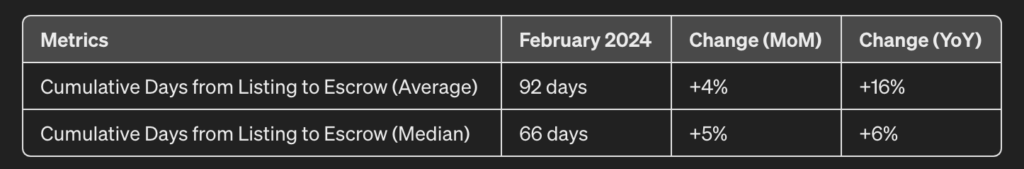

Despite the increase in sales activity and prices, the cumulative days from listing to escrow witnessed a slight uptick, with the average days increasing by 4% to 92 days. Similarly, the median days on the market rose by 5%, reaching 66 days. While these figures suggest a marginal slowdown in the pace of transactions, they remain relatively low compared to national averages, indicating continued market strength and buyer interest.

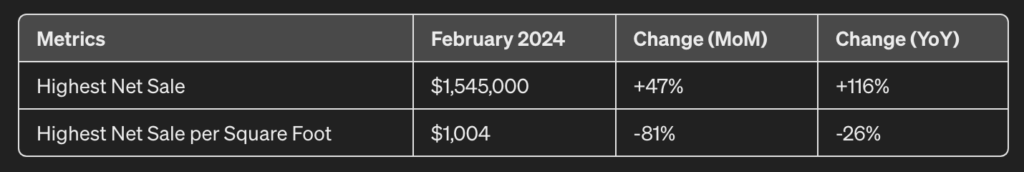

Though well outside the investment profile of our OZ fund, the luxury segment of the Austin real estate market demonstrated remarkable performance, with the highest net sale reaching $1,545,000, representing a substantial 47% increase from the previous month and an impressive 116% surge from the same period last year. However, it’s worth noting that the price per square foot for luxury properties experienced a significant decline, highlighting potential fluctuations within this segment of the market.

The Q1 2024 statistics for the Austin real estate market paint a picture of resilience, growth, and opportunity. Despite global economic uncertainties and fluctuations in other housing markets, Austin continues to attract buyers and investors with its strong fundamentals, diverse economy, and quality of life. As we navigate the evolving landscape of real estate, staying informed about market trends and insights provided by sources like ALEX.realestate is crucial for making informed decisions whether buying, selling, or investing in Austin’s dynamic housing market.

Liquid’s investment management team are here to help with strategies for placing capital into funds and developing opportunity zone projects across the City of Austin. Need help with something? Please feel free to get in touch today.

Email: info AT liquidoz.com

Website: liquidoz.com

Twitter: @LiquidOZFund

Facebook: @LiquidOZFund