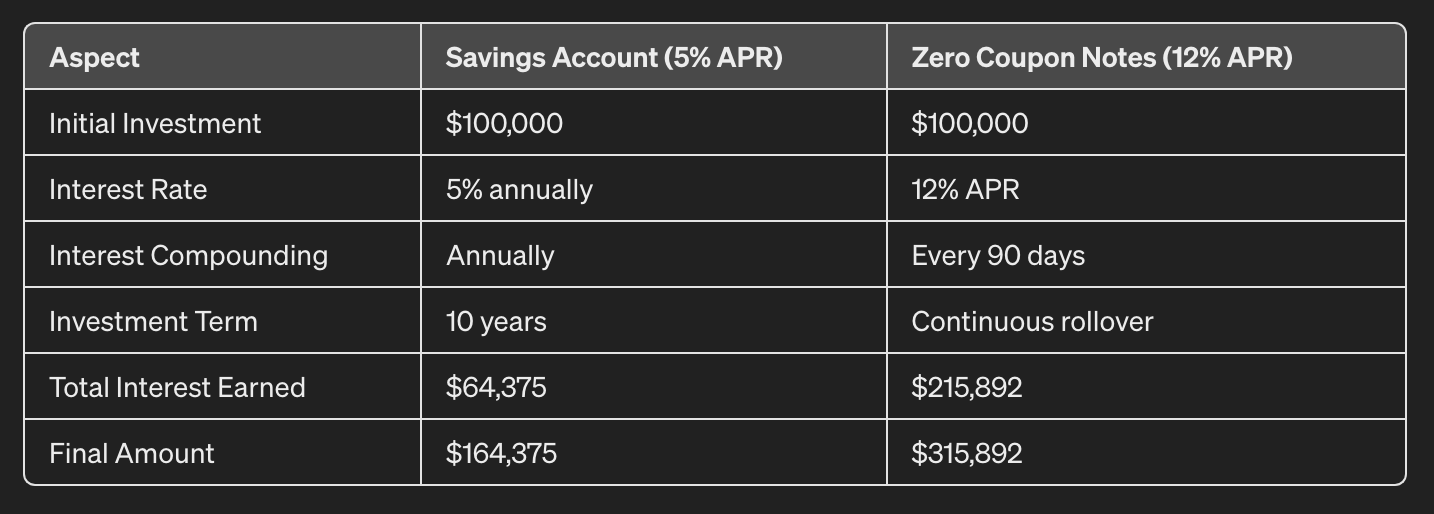

2x Your Savings Income

Boost your savings income from 4% to over 8%+ with fixed-rate Bonds

Stop stressing about your monthly budget. Earn more for retirement. Outpace inflation. Retire sooner.

Take back your financial freedom!!

- Principal + Interest back in 90 days

- Compounding interest, long-term growth (8%+ APY)*

- No long-term commitments

- Compound your gains every 90 Days

- Fully collateralized by Real World Assets

- Exit anytime without penalty

- YES! Bonus rates are possible, if...

Read the full terms and conditions here.